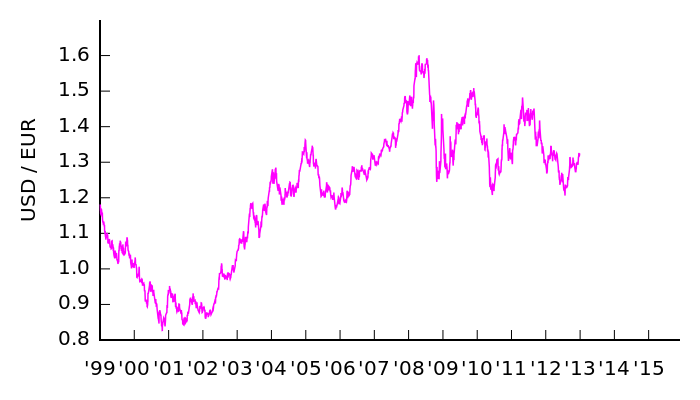

The exchange rate today 22 March 2013 is 1 euro = US$1.2973250175 so there has not been a run, not yet.

Euro ex Wiki

QUOTE

The euro (sign: €; code: EUR) is the currency used by the Institutions of the European Union and is the official currency of the Eurozone, which consists of 17 of the 27 member states of the European Union: Austria, Belgium, Cyprus, Estonia, Finland, France, Germany, Greece, Ireland, Italy, Luxembourg, Malta, the Netherlands, Portugal, Slovakia, Slovenia, and Spain. [2][3] The currency is also used in a further five European countries and consequently used daily by some 332 million Europeans.[4] Additionally, more than 175 million people worldwide—including 150 million people in Africa—use currencies pegged to the euro.The euro is the second largest reserve currency as well as the second most traded currency in the world after the United States dollar.[5][6] As of September 2012, with more than €915 billion in circulation, the euro has the highest combined value of banknotes and coins in circulation in the world, having surpassed the US dollar.[note 14] Based on International Monetary Fund estimates of 2008 GDP and purchasing power parity among the various currencies, the Eurozone is the second largest economy in the world.[7]

The name euro was officially adopted on 16 December 1995.[8] The euro was introduced to world financial markets as an accounting currency on 1 January 1999, replacing the former European Currency Unit (ECU) at a ratio of 1:1 (US$1.1743). Euro coins and banknotes entered circulation on 1 January 2002.[9] While the euro dropped subsequently to US$0.8252 within two years (26 October 2000), it has traded above the US dollar since the end of 2002, peaking at US$1.6038 on 18 July 2008.[10] Since late 2009, the euro has been immersed in the European sovereign-debt crisis which has led to the creation of the European Financial Stability Facility as well as other reforms aimed at stabilising the currency. In July 2012, the euro fell below US$1.21 for the first time in two years, following concerns raised over Greek debt and Spain's troubled banking sector.[11]

UNQUOTE

The Wiki is telling the truth more or less.

Southern Europe Is On A Precipice [ 02 Nov 2013 ]

Says Ambrose Evans-Pritchard, a first rate journo. The euro is a bad idea. It always was. Now people are suffering big time as a result.

Euro Currency Will Collapse Says Its Inventor [ 17 October 2016 ]

QUOTE

The European Central Bank is becoming dangerously over-extended and the whole euro project is unworkable in its current form, the founding architect of the monetary union has warned. Prof Issing said the euro has been betrayed by politics, lamenting that the experiment went wrong from the beginning and has since has degenerated into a fiscal free-for-all that once again masks the festering pathologies.“Realistically, it will be a case of muddling through, struggling from one crisis to the next. It is difficult to forecast how long this will continue for, but it cannot go on endlessly," he told the journal Central Banking in a remarkable deconstruction of the project. Prof Issing the lambasted the European Commission.

UNQUOTE

Politicians with agendas experiment on us and walk away rich. We were told loudly, incessantly that without the Euro we were doomed. They were fools, rogues and ignoramuses.

Juncker's 'Torture Tools' Are Useless Against Italy's Well-Armed Uprising [ 26 May 2018 ]

QUOTE

Brussels prides itself on well-honed ways to bring recalcitrant governments to heel. "We have instruments of torture in the basement,” jokes Jean-Claude Juncker.Europe's cheerful chief enforcer tests our humour. The methods deployed against a string of distressed nations from 2010 to 2014 were illegal, unconstitutional, and scandalous, though carried out with the complicity of vested interests in each country. This created a cloak of legitimacy.

Athanasios Orphanides, a former governor at the European Central Bank, says the nuclear weapon is the ECB’s control over sovereign bond spreads and liquidity for the banks. “They threaten governments that misbehave with financial destruction. They try to scare them into voluntary acceptance of policies,” he said .

“They cut off refinancing and threaten to kill the banking system. They create a roll-over crisis in the bond market. This is what happened to Italy in 2011,” he said.

Prof Orphanides, now safely distant at MIT in Boston, says the ECB was careful not to leave a paper trail or take decisions that could be challenged in court. “They operate in a grey area without clear legal authority.”

The trick is to work hand in glove with the #Eurogroup, the Star Chamber of EMU finance ministers that is accountable to no democratic body and is essentially under the control of the German finance ministry. “What happens is that everybody at the Eurogroup meeting gangs up on the country they want to attack,” he said.

One saw the reflexes of an authoritarian proto-imperial entity during the crisis. To compound the damage, the policy prescriptions were incompetent. They led to an economic depression deeper than the 1930s. The end did not even justify the means.

Covering this episode closely as a journalist is a key reason why I voted for Brexit, knowing that British withdrawal from the EU would be traumatic. The counterfactual of remaining in Mr Juncker’s lawless dungeon was ultimately worse.

The EU’s gendarmes are now eyeing Italy’s rebel coalition with professional curiosity. This is a harder nut to crack. For the first time since the creation of monetary union they face a government in which the critical mass of sentiment is Eurosceptic. The ‘Italy First’ cohorts of the Lega openly extol the patriotic lira - or the new florin as it may be called.

A crude attempt to bully the Lega and Davide Casaleggio’s Five Star techno-mystics risks defiance and a dangerous chain-reaction, ending in a €2 trillion default on German credits to southern Europe and the devastation of the EU project.

The enforcers must be subtle. They will try to peel off the softer Five Star ‘Grillini’, those such as nominal leader Luigi di Maio are already showing eagerness for EU approval. They will exploit divisions in Italian society just as they are doing in Brexit Britain. They will mobilize the ‘poteri forti’ of Confindustria and the mandarin class.

The Italian drama of 2011 is illuminating. The ECB used the bond market as a political tool. It switched purchases on and off to pressure Silvio Berlusconi, dictating detailed domestic policies in a secret letter (later leaked). It ordered specific reforms of the labour law, a neuralgic issue that had already led to two assassinations. It demanded austerity overkill on the urging of ‘ordoliberal’ quack economists in Berlin.

When Berlusconi balked, the ECB engineered a bond crisis. It chose a moment when contagion from the Spanish banking crash had left Italy vulnerable. This paved the way for a coup d'état, orchestrated by the ex-Stalinist Italian president of the day. Berlusconi was toppled. A former EU commissioner, Mario Monti, was parachuted in with a team of officials from Brussels.

The ECB had no treaty mandate to do any of this. It was acting ultra vires. There was not a whisper of criticism from the European press corps. Don’t rely on them to expose arbitrary practice and defend the rule of law.

The forgiving verdict is that EU officials had to take these measures to save the euro. Yet the Eurozone financial crisis was of their own making. It happened because the ECB failed to fulfill its primary central bank purpose as a lender-of-last resort in a crisis (at a penalty rate, true to Bagehot). The crisis stopped instantly when Berlin lifted its veto and authorized Mario Draghi to “do whatever it takes” in mid-2012.

Claudio Borghi, the Lega's economics chief, says the EU cannot pull off the same trick a second time. Italians are alert to the legerdemain. "Everybody can see that the spreads are a tool of political manipulation," he said.

What unites the Lega and Grillini is a shared suspicion that Germany has gamed monetary union, setting the rules to its own advantage. Many think it pursued a mercantilist beggar-thy-neighbour strategy (in effect, if not by intent), undercutting Italy's real effective exchange rate (REER) and trapping the country in a depression.

The effect in the particular circumstances of Italy - which used to have a trade surplus with Germany - has been debt-deflation, corrosive deindustrialization, an unjustified banking crisis (Italian banks were not the villains of pre-Lehman excess), and youth jobless rates above 50pc in the South. The Lega-Grillini may not understand the exact economic mechanisms. But their intuitive conclusion is broadly correct. Italy was as much sinned against than sinner.

The ECB's liquidity weapons can only work against a nation that is naive, has disarmed itself, and fears ejection from EMU. If subjected to Juncker's torture, the insurgent alliance would probably activate its plan for 'minibot' Treasury notes and launch its parallel currency. It would reassert national control over the banking system.

In other words, Italy would do what Yanis Varoufakis wanted to do in Greece: wage guerrilla warfare. The Greek finance minister was famously stopped by the Syriza 'war cabinet' in 2015. The plan was too radical.

The battle-scarred Mr Varoufakis is now watching the Italian drama with forensic fascination. He thinks the Eurogroup has met its match this time. German talk of a Target2 payment freeze to the Bank of Italy rings false. "It is an empty threat," he said.

Lega strongman Matteo Salvini almost seems to relish the chance to fight Brussels, Berlin, and the bond vigilantes. He dares his enemies to play the spread game. He once described the euro as a "crime against humanity" - to me as it happens.

"Salvini positively wants to get out of the euro. Alexis Tsipras did not. That is a profound difference," said Mr Varoufakis. He sees an unstoppable sequence as the Lega-Grillini budget blitz blows up the EU Fiscal Compact and the Stability Pact.

"The flat tax will create a big hole in the budget. There will be market tensions and the usual reactions from Germany," he said. The coalition will defend itself with minibots (though he advises them to keep it digital, rather than issuing paper - a fine legal point - and to avoid calling it a 'currency').

"There will be immediate capital flight. They will have to impose capital controls. Italians will find almost surreptitiously that they are no longer in the euro, without a referendum, without a vote," he told The Telegraph. It will just happen. the EU has a choice. It can bow to the fait accompli of Italy's revolt and allow Rome to let rip with fiscal reflation. It can accept that the euro has slipped German control, and that EMU is henceforth a lira-zone on Club Med terms. In which case Germany may leave.

Or it can pull out the thumbscrews, the pillory, and the rack, working day and night to overturn Italian democracy. If this succeeds, it can only be at an extremely high political cost. But it might not succeed. In which case Italy may leave, taking Spain, Portugal, Greece, and much of the German banking system with it.

In a dysfunctional monetary union, you pick your poison.

UNQUOTE

Ambrose Evans-Pritchard is a first rate journo, one that gets taken seriously by people in the finance industry. I strongly suspect that he is right for the right reasons. Italy is analogous to someone in debt. If the amount is huge, the bank has a problem, not the borrower. Bankruptcy solves problems for debtors. NB He is right about the #Eurogroup, a private group of co-conspirators.

Eurogroup ex Wiki

The Eurogroup is the recognised collective term for informal meetings

of the

finance ministers of the

Eurozone—those

member states of the European Union (EU) which have adopted the

euro as their

official

currency.

The group has 19 members. It exercises political control over the currency and related aspects of the EU's monetary union such as the Stability and Growth Pact. Its current president is Mário Centeno, the Minister of Finance of Portugal.[1]

The ministers meet in camera a day before a meeting of the Economic and Financial Affairs Council (Ecofin) of the Council of the European Union. They communicate their decisions via press and document releases. This group is related to the Council of the European Union (only Eurogroup states vote on issues relating to the euro in Ecofin) and was formalised under the Lisbon Treaty.

Euro Falling As The Dollar Climbs [ 13 May 2022 ]

QUOTE

Money market traders predict that the reluctance of the European Central

Bank, or ECB, to tighten inflation-fighting policy in line with the United

States Federal Reserve, could push the euro down to parity with the dollar,

a level unseen since 2002.

Some 60 percent of respondents to Bloomberg's latest MLIV Pulse survey expect the euro will eventually end up level with the dollar. It noted that some 40 percent of respondents fear a Eurozone recession more than inflation.

The looming threat of a recession means the ECB will prioritize keeping control of government borrowing costs over lifting interest rates above zero, according to Amundi, Europe's largest asset manager.

In an interview with the Financial Times, Vincent Mortier, chief

investment officer at Amundi, said the euro would fall in line with the US

dollar this year.

UNQUOTE

Holding real assets makes more sense than having bits of paper. That goes

double when your wonderful government decides to print more money. It is

crime when we do it & Government Policy

when they do it. Gold has virtue. It can't be

created out of thin air or destroyed. NB The pound is also drooping. The

Source here is the China Daily,

owned and run by the

Chinese

Communist Party. Biased? Somewhat. In whose favour? China's. Who should

you believe? Not American Mainstream Media or the

BBC.