Doctor Roberts, a real economist explains American government manipulation. It is to hold off dollar collapse.

Gold As An Investment - The Guardian Explains All

QUOTE

Bullion firm reveals that British

holdings increased tenfold in five years

Speculators and safe-haven investors have ploughed hundreds of millions

of pounds in to gold since the financial -crisis began........

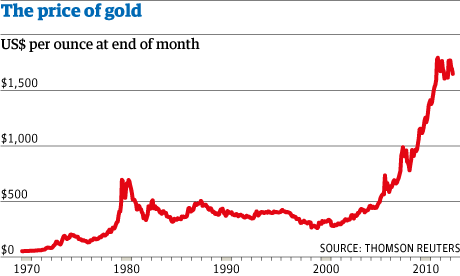

The price has been also been driven higher by some of the measures taken to combat the economic downturn. The Bank of England, the US Federal Reserve and the Bank of Japan have pumped hundreds of billions of dollars [ by printing them, thus generating inflation, just like forgery - Editor ] into the world economy in a bid to prevent a global slump – and that has helped pump up the gold price.

As a result it has been a glittering investment. Yesterday gold was selling on the London markets at $1,585 an ounce on Thursday, down 0.27% on the day before......

But predicting the price of gold is essentially a mug's game –

Gordon Brown famously lost out by selling large chunks of the UK's

gold reserve between 1999 and 2002, getting a lowly price of between

just $250 and $300 an ounce.

UNQUOTE

Buy it or hold it? Hold anyway. Buy more? Maybe.

Cash in the bank is something governments can steal - even if they

do not just print it then spend it. Forgery is crime when honest men do

it.

23rd Bank Failure Of 2009

QUOTE

NEW YORK — Federal regulators shut down two more banks Friday, raising the

number of bank failures so far this year to 23. The first bank was Cape Fear

Bank in Wilmington, N.C., the first North Carolina bank to fail in nearly 16

years. The other bank was New Frontier Bank of Greeley, Colo., the second

Colorado bank this year to collapse. The Federal Deposit Insurance Corp. took

over both banks Friday after their respective state regulators closed them

down........ This year's tally of 23 bank failures is nearing the total for

all of 2008, when 25 U.S. banks were seized by regulators. Two of the nation's

largest savings and loans failed that year: Washington Mutual Inc. . and

IndyMac Corp.

UNQUOTE

Moving your money into something with real value makes sense. Gold is one

potential answer. Governments can't destroy its value. That is why they don't

like it but the crime industry has moved in. Tungsten with gold plating is how

punters are being robbed.

How to Make Convincing Fake-Gold Bars has pointers.

How to Make Convincing Fake-Gold Bars

QUOTE

On Wednesday,

the BBC reported that millions of dollars in gold at the

central bank of Ethiopia has turned out to be fake: What were

supposed to be bars of solid gold turned out to be nothing more

than gold-plated steel. They tried to sell the stuff to South

Africa and it was sent back when the South Africans noticed this

little problem. This is an amazing story for two reasons. First, that an

institution like a central bank could get ripped off this way, and

second that the people responsible used such a lousy excuse for

fake gold.

I consider myself something of an expert on fake gold (I'm not really, I just think I am) ever since I was asked to give advice on the subject to the author Damien Lewis for his recent thriller, Cobra Gold. I worked out in detail for him how you could make really convincing fake gold, and ended up as a minor character in the novel, where I am known as "Goldfinger Gus".

The problem with making good-quality fake gold is that gold is remarkably dense. It's almost twice the density of lead, and two-and-a-half times more dense than steel. You don't usually notice this because small gold rings and the like don't weigh enough to make it obvious, but if you've ever held a larger bar of gold, it's absolutely unmistakable: The stuff is very, very heavy.

The standard gold bar for bank-to-bank trade, known as a "London good delivery bar" weighs 400 troy ounces (over thirty-three pounds), yet is no bigger than a paperback novel. A bar of steel the same size would weigh only thirteen and a half pounds.

According to the news, the authorities have arrested pretty much everyone involved, from the people who sold the bank the gold, to bank officials, to the chemists responsible for testing and approving it on receipt.

The problem is, anyone who so much as picked up one of these bars should have known immediately that they were fake, no fancy test required. The weight alone is an instant dead giveaway. Even a forklift operator lifting a palette full of them should have noticed that his machine wasn't working hard enough. I think they must have been swapped out while in storage: Someone walked in each day with a new fake gold bar and walked out with a real one. If they were fake on arrival then everyone who handled them in any way must have either had no experience with gold or been in on the scam.

Now, for me the more interesting question is, how do you make a fake gold bar that at least passes the pick-it-up test? The problem is that there are very few metals that are as dense as gold, and with only two exceptions they all cost as much or more than gold.

The first exception is depleted uranium, which is cheap if you're a government, but hard for individuals to get. It's also radioactive, which could be a bit of an issue.

The second exception is a real winner: tungsten. Tungsten is vastly cheaper than gold (maybe $30 dollars a pound compared to $12,000 a pound for gold right now). And remarkably, it has exactly the same density as gold, to three decimal places. The main differences are that it's the wrong color, and that it's much, much harder than gold. (Very pure gold is quite soft, you can dent it with a fingernail.)

A top-of-the-line fake gold bar should match the color, surface hardness, density, chemical, and nuclear properties of gold perfectly. To do this, you could start with a tungsten slug about 1/8-inch smaller in each dimension than the gold bar you want, then cast a 1/16-inch layer of real pure gold all around it. This bar would feel right in the hand, it would have a dead ring when knocked as gold should, it would test right chemically, it would weigh *exactly* the right amount, and though I don't know this for sure, I think it would also pass an x-ray fluorescence scan, the 1/16" layer of pure gold being enough to stop the x-rays from reaching any tungsten. You'd pretty much have to drill it to find out it's fake. (Unless, of course, central bank gold inspectors are wise to this trick and have developed a test for it: Something involving speed of sound say, or more powerful x-rays, or perhaps neutron activation analysis. If bars like this are actually a common problem, you certainly could devise a quick, non-destructive test for them, and for all I know, they have. Except, apparently, in Ethiopia.)

Such a top-quality fake London good delivery bar would cost about $50,000 to produce because it's got a lot of real gold in it, but you'd still make a nice profit considering that a real one is worth closer to $400,000. A lower budget version could be made by using the same under-sized tungsten slug but casting lead-antimony alloy around it (to match the hardness, sound, and feel of gold), then electroplating on a heavy coating of gold. Such a bar would still feel and sound right and be only very slightly underweight, while costing less than $500 to produce in quantity. It would not pass x-ray fluorescence, and whether it passes a chemical test would depend on how thick the electroplating is.

This is the solution I recommended for Cobra Gold, because they only needed their fake gold to pass a field inspection, which is to say, someone picking it up and knowing what gold should feel like when you lift it. You may quibble for other aspects of the plot if you like, but I think the fake gold would have worked.

And let me tell you, it's a sad

day for criminal masterminds when my fictional fake gold, designed

only to trick a terrorist cell, is so much better than the real

fake gold used to rip off a real government bank for millions of

real dollars.

London Bullion

Market

QUOTE

Unallocated Accounts

Unallocated Accounts represent the most popular way of trading, settling

and holding gold, silver, platinum and palladium. Transactions may be settled

by credits or debits to the account while the balance represents the

indebtedness between the two parties. Credit balances on the account do not

entitle the creditor to specific bars of gold or silver or plates or ingots of

platinum or palladium but are backed by the general stock of the precious

metal dealer with whom the account is held. The client in this scenario is an

unsecured creditor.

Unallocated Risks

The total quantity of unallocated gold is estimated to be 15,000 tonnes at

the end of 2008

which supports the 2,134 tonnes on average of spot gold trade through London

every day representing 14.2% of the pool. This compares to average daily

turnover in UK equities of between 0.34% and 0.63% for the 12 months ending

September 2009. While members of the LBMA provide no information

on the backing for unallocated gold the improbably high turnover is suggestive

they are operating a fractional reserve system where unallocated accounts are

only partially backed by physical gold. Similarly to a

bank run this makes LBMA

unallocated gold accounts susceptible to loss if a sufficient number of market

participants request delivery of physical bullion.

UNQUOTE

Gold

trading with unallocated accounts sounds dodgy.

http://open.salon.com/blog/gordon_wagner/2010/11/08/more_on_fake_tungsten-filled_gold_bars

http://www.marketoracle.co.uk/Article14996.html

http://www.freerepublic.com/focus/f-news/2636175/posts

news.yahoo.com ...

Fake Gold Scam Hammers Hong Kong Jewelers

QUOTE

London: With the gold price sitting at record

highs, Hong Kong jewellers and pawn shops have been hammered by one of the

most sophisticated scams in which hundreds of ounces of fake gold were

traded in the market.

The gold-mad city has woken up to a massive scam as investigators discovered that at least 200 ounces of fake bullion, worth about $250,000 have been traded at the island's fabled jewellery souks so far this year, it was reported, in what could be a warning for gold obsessed Indians.

"It's a very good fake", said Haywood Cheung, President of the Chinese Gold and Silver Exchange Society, Hong Kong's hundred year old gold exchange. Though officially only 200 ounces of fake gold was recorded as traded, Cheung estimated that ten times that amount might have infiltrated the retail market.

Describing the swindle as " one of the most sophisticated scams to hit Hong Kong gold market in decades", the Financial Times said it has come when the price of gold has soared to record highs of $1,400 an ounce.

In some cases, traders discover a pure gold coating that must [ be ] a complex alloy with similar properties to gold. The fake gold had 51 per cent purity while the rest comprised other metals like nickel, iron, copper, rhodium, iridium and osmium.

So real did the fakes look that even some of the Hong Kong's leading jewellers like 'Even Luk Fook Group' was tricked into buying some before it put its chain of stores on alert. "This was the biggest hit ever", said Paul Law, Executive Director of the firm as saying and experts say that the highly sophisticated equipment was used to fake the bullion.

The fakes were extremely hard to detect by sight and touch alone. In most cases, they passed basic scrutiny, only to be revealed later by more sophisticated tests involving high temperatures and chemicals.

In the past, counterfeit gold in Hong Kong and the rest of Asia was

either rough and easy to detect, even to the naked eye, or involved

gold-plated tungsten, a metal with a similar density to gold, but which

traders and jewellers can easily identify.

UNQUOTE

http://www.marketoracle.co.uk/Article14996.html

An obscure news item originally published in the N.Y. Post

[written by Jennifer Anderson] in late Jan. 04 has always ‘stuck in my craw’:

DA investigating NYMEX executive - Manhattan, New York, district attorney's office, Stuart Smith - Melting Pot - Brief Article – Feb. 2, 2004

A top executive at the New York Mercantile Exchange is being investigated by the Manhattan district attorney. Sources close to the exchange said that Stuart Smith, senior vice president of operations at the exchange, was served with a search warrant by the district attorney's office last week. Details of the investigation have not been disclosed, but a NYMEX spokeswoman said it was unrelated to any of the exchange's markets. She declined to comment further other than to say that charges had not been brought. A spokeswoman for the Manhattan district attorney's office also declined comment.

https://en.wikipedia.org/wiki/Nixon_shock

Nixon

Versus Gold ex Wiki

The Nixon shock was a series of economic measures undertaken by

United States

President

Richard Nixon in 1971, in response to increasing inflation, the most

significant of which were wage and price freezes, surcharges on imports, and

the unilateral cancellation of the direct international

convertibility of the

United States

dollar to gold.[1]

While Nixon's actions did not formally abolish the existing Bretton Woods system of international financial exchange, the suspension of one of its key components effectively rendered the Bretton Woods system inoperative. While Nixon publicly stated his intention to resume direct convertibility of the dollar after reforms to the Bretton Woods system had been implemented, all attempts at reform proved unsuccessful. By 1973, the Bretton Woods system was replaced de facto by the current regime based on freely floating fiat currencies.[2]

In 1944, representatives from 44 nations met in Bretton Woods, New Hampshire to develop a new international monetary system that came to be known as the Bretton Woods system. Conference attendees had hoped that this new system would "ensure exchange rate stability, prevent competitive devaluations, and promote economic growth".[3] It was not until 1958 that the Bretton Woods system became fully operational. Countries now settled their international accounts in dollars that could be converted to gold at a fixed exchange rate of $35 per ounce, which was redeemable by the U.S. government. Thus, the United States was committed to backing every dollar overseas with gold, and other currencies were pegged to the dollar.

For the first years after World War II, the Bretton Woods system worked well. With the Marshall Plan, Japan and Europe were rebuilding from the war, and countries outside the US wanted dollars to spend on American goods—cars, steel, machinery, etc. Because the U.S. owned over half the world's official gold reserves—574 million ounces at the end of World War II—the system appeared secure.[4]

However, from 1950 to 1969, as Germany and Japan recovered, the US share of the world's economic output dropped significantly, from 35% to 27%. Furthermore, a negative balance of payments, growing public debt incurred by the Vietnam War, and monetary inflation by the Federal Reserve caused the dollar to become increasingly overvalued in the 1960s.[4]

In France, the Bretton Woods system was called "America's exorbitant privilege"[5] as it resulted in an "asymmetric financial system" where non-US citizens "see themselves supporting American living standards and subsidizing American multinationals". As American economist Barry Eichengreen summarized: "It costs only a few cents for the Bureau of Engraving and Printing to produce a $100 bill, but other countries had to pony up $100 of actual goods in order to obtain one".[5] In February 1965 President Charles de Gaulle announced his intention to exchange its U.S. dollar reserves for gold at the official exchange rate.[6]

By 1966, non-US central banks held $14 billion, while the United States had only $13.2 billion in gold reserve. Of those reserves, only $3.2 billion was able to cover foreign holdings as the rest was covering domestic holdings.[7]

By 1971, the money supply had increased by 10%.[8] In May 1971, West Germany left the Bretton Woods system, unwilling to revalue the Deutsche Mark.[9] In the following three months, this move strengthened its economy. Simultaneously, the dollar dropped 7.5% against the Deutsche Mark.[9] Other nations began to demand redemption of their dollars for gold. Switzerland redeemed $50 million in July.[9] France acquired $191 million in gold.[9] On August 5, 1971, the United States Congress released a report recommending devaluation of the dollar, in an effort to protect the dollar against "foreign price-gougers".[9] On August 9, 1971, as the dollar dropped in value against European currencies, Switzerland left the Bretton Woods system.[9] The pressure began to intensify on the United States to leave Bretton Woods.

Gold Under The Mattress vs Gold Investment ex ZeroHedge

QUOTE

Wednesday, Jan 12, 2022 - 11:11

By Erik Oswald

“If you can’t hold it in your hand, you don’t own it.”

That’s one of the most common refrains we hear from gold and silver investors. And while there is a kernel of truth in this saying, investing by these words alone could prove a costly mistake.

This popular phrase conflates and entangles two different concepts.

- Gold owned for emergency use or as a financial insurance policy

- Gold owned for investment purposes

In this article, we’ll untangle those ideas and offer a different way to think about owning gold.

The Dangers of Holding Too Much in Hand

Reductio ad absurdum is helpful here. Immediately, we can think of many things that we really do own, but that we cannot hold in our hand.

More importantly though, taking this phrase to its logical conclusion introduces a multitude of risks.

Imagine taking all your money out of the bank, taking physical delivery of paper stock and bond certificates, and of course all your gold and silver, then storing your wealth within arm’s reach.

Suppose you’re robbed? A fire or some other natural or manmade disaster strikes?

You could lose or forget where you put things or forget an important safe combination.

Even if the risk were acceptable, there’s still the issue of practicality, which grows more difficult the wealthier you become.

“If you can’t hold it, you don’t own it” may be a catchy slogan, but following this logic alone is impractical and extremely risky.

Gold for Emergencies and as a Financial Insurance Policy

Given the risks inherent in the financial system, keeping some physical gold and silver at home as an emergency fund or as a financial insurance policy is warranted.

The threshold for how much to keep at home is different for everybody. Beyond that, it’s time to put that metal in a secure depository with insurance and professional security. However, now you must pay yearly storage fees, which will perpetually eat away at your principal.

Gold for Investment Purposes

If gold isn’t owned as an emergency fund or insurance policy, what other purpose does it serve? The fundamental purpose of savings and investment is to deploy capital productively so that it produces a yield. You had always been able to do this with dollars, but your options are looking fairly bleak and with the Fed continually issuing more dollars, any dollar yields will be hit with the ever growing inflation tax.

Monetary Metals has made it possible for investors to earn a yield on gold and silver. Precious metals are no longer relegated to mere financial insurance but can be used to grow your net worth in real terms.

Purchasing gold with the expectation of selling it for more dollars is not an investment, but a speculation. An investment finances production, and the profit to investors comes from that production. A speculation finances nothing, just a bet on the price of an asset, and the profit comes from the capital paid by the next speculator who buys it from you. To understand the difference between gold speculation and gold investment, I recommend two articles:

Investing in Gold vs Gold Investing

There are those who will continue to speculate for more dollars with gold, bitcoin, tulips, or penguin GIF NFT’s. However, gold under the mattress isn’t going to sprout any additional ounces.

Civilization was not built or advanced by speculation. It was built on productive investment. This is what Monetary Metals offers, an inflation-resistant return on invested capital, paid in gold and silver. Not mere protection of wealth, but the power to grow that wealth year over year................

In this paper we look at how conventional gold holdings stack up to Monetary Metals Investments, which offer a Yield on Gold, Paid in Gold®. We compare retail coins, vault storage, the popular ETF - GLD, and mining stocks against Monetary Metals’ True Gold Leases.

The Case for Gold Yield in Investment Portfolios

Adding gold to a diversified portfolio of assets reduces volatility and increases returns. But how much and what about the ongoing costs? What changes when gold pays a yield? This paper answers those questions using data going back to 1972.

© 2022 Monetary Metals

UNQUOTE

Do you believe everything you read? Me neither. There are some

important points there BUT.......................